Opening Home Value:

Grasping the Advantages and disadvantages of reverse mortgage:

Presentation:

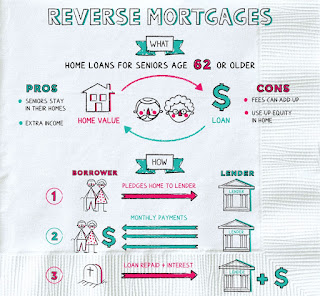

What is a reverse mortgage?

A house buyback is a credit accessible to mortgage holders matured 62 and more seasoned, empowering them to change over a piece of their home value into cash. In contrast to conventional home loans, where property holders make regularly scheduled installments to banks, graduated house buybacks include the moneylender making installments to the property holder. This monetary plan permits seniors to get to assets without selling their homes, giving a likely answer for those confronting retirement with restricted pay.

Professionals of reverse mortgage:

1. Supplemental Income:

One of the essential advantages of a home buyback is the capacity to get a flood of pay, assisting seniors with covering day to day everyday costs or unforeseen clinical expenses.

2. Homeownership Retention:

Seniors can keep on residing in their homes without the weight of month to month contract installments, as the advance is normally reimbursed when the mortgage holder sells, moves out, or dies.

3. Flexible Installment Options:

Cons of Home reverse mortgage:

1. Accumulating Interest:

Since premium accumulates on the credit over the long haul, the sum owed can develop fundamentally, possibly influencing the legacy left to beneficiaries.

2. Home Value Reduction:

As the credit is reimbursed, the mortgage holder's value diminishes, which could restrict the resources accessible to main beneficiaries.

3. Complexity and Costs:

Graduated house buybacks accompany different charges and shutting costs, making them more complicated and possibly costly contrasted with customary home loans.

Contemplations and Alerts:

1. Counseling Requirement:

Prior to getting a house buyback, property holders are expected to go through directing to guarantee they completely grasp the ramifications and options.

2. Impact on Government Benefits:

3. Future Planning:

Seniors ought to painstakingly survey their drawn out plans and talk with monetary guides to decide whether a home buyback lines up with their by and large monetary methodolog.

Conclusion:

Graduated ho Reverse mortgage an be a significant monetary device for seniors looking to use their home value in retirement. Nonetheless, it's urgent for people to gauge the advantages and disadvantages, think about other options, and pursue informed choices in view of their novel monetary conditions. Similarly as with any monetary choice, looking for proficient counsel is vital to guarantee a protected and agreeable retirement.